Understanding the Hidden Costs of Payment Processing Fees for E-Commerce Owners

October 25, 2025 | by qqvmedia.com

The Impact of Payment Processing Fees on E-Commerce Profitability

Payment processing fees are a critical aspect of managing an e-commerce business, yet many new owners underestimate their potential impact on overall profitability. These fees can be categorized into two main types: fixed and variable costs. Fixed costs typically include monthly service fees, while variable costs are usually a percentage charged per transaction. Both types contribute to the financial burden that e-commerce businesses face and can significantly erode profit margins if not accounted for properly.

One common misconception among new e-commerce owners is that the percentage charged per transaction is the only cost they need to worry about. However, hidden fees often accompany payment processing services—such as chargeback fees, currency conversion fees, and maintenance fees—that can add up quickly. For instance, a business may offer its customers the option to pay with multiple methods, including credit cards and digital wallets. Each payment method may have a different fee structure, and failure to fully understand these can result in inflated costs.

As an example, consider an e-commerce store selling products for $100. If the payment processor charges a flat fee of $0.30 plus 2.9% per transaction, the total fee for a single sale would be $3.20. This means the store retains only $96.80 from that sale. Now, if the store processes 100 transactions in a month, the accumulated fees would total $320, a significant deduction that affects the bottom line. Such scenarios highlight the importance of diligently analyzing payment processing fees and their implications on overall profitability.

In conclusion, understanding the nuances of payment processing fees is essential for e-commerce owners aiming to maximize their profitability. By being aware of both fixed and variable costs associated with different payment methods, businesses can make informed choices that protect their profit margins while still providing excellent customer service.

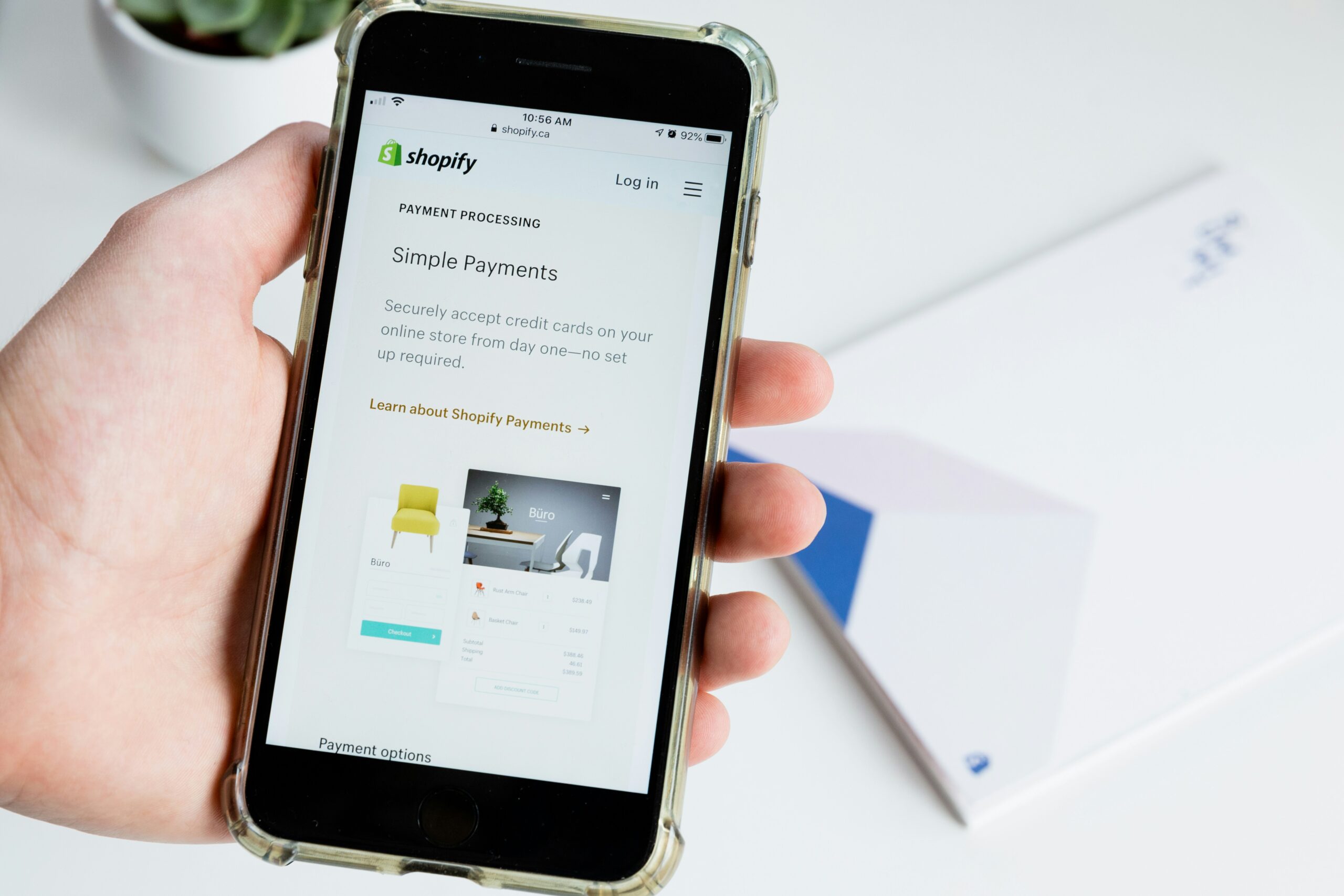

Selecting the Right Payment Gateway: Balancing Cost, Security, and Convenience

Choosing the appropriate payment gateway is a critical decision for e-commerce owners, as it impacts not only the operational costs but also customer experience and trust. When evaluating payment gateway options, one must consider several vital factors: cost, security features, and ease of use. Each of these elements plays a significant role in shaping the transaction experience for customers, ultimately affecting conversion rates and customer loyalty.

Cost is often the primary concern for e-commerce proprietors. Various payment gateways impose different fee structures, including transaction fees, monthly fees, and chargeback fees. E-commerce owners should analyze these costs in relation to their sales volume and business model to ensure they select a payment processor that aligns with their budgetary constraints. However, focusing solely on cost may lead to unforeseen challenges. Choosing a provider with lower fees might compromise essential security features, resulting in a vulnerable checkout process.

Security is another critical component that must not be overlooked. A reputable payment gateway should comply with the Payment Card Industry Data Security Standard (PCI DSS), ensuring that customers’ sensitive information is encrypted and securely handled. Robust fraud detection tools and preventive measures against data breaches are essential features that contribute to a secure shopping environment, fostering trust with customers. E-commerce owners should carefully review the security protocols of potential payment gateways to ensure they meet high standards.

Lastly, convenience plays a crucial role in the overall shopping experience. A user-friendly interface enhances the checkout process, minimizes cart abandonment, and boosts customer satisfaction. Seamless integration with the e-commerce platform and support for various payment methods are vital aspects to consider. A well-designed payment gateway not only simplifies transactions but also enhances customer retention by creating a positive shopping experience. By carefully balancing these factors, e-commerce owners can select a payment gateway that meets their needs while ensuring customer satisfaction and security.

Comparing Fee Structures: Flat-Rate vs. Percentage-Based Fees

In the realm of e-commerce, understanding the intricacies of payment processing fees is paramount for business owners looking to optimize their profitability. Two predominant fee structures exist within payment processing: flat-rate fees and percentage-based fees, each with distinct implications for an e-commerce business’s bottom line.

Flat-rate fees are straightforward and predictable, charging a set amount per transaction regardless of the transaction’s total value. This simplicity can be beneficial for e-commerce owners who prioritize budget stability and need to forecast expenses accurately. For instance, if a payment processor charges a flat rate of $0.30 plus 2.9% on each transaction, a seller processing a $100 sale would pay $3.20. Flat-rate pricing often works best for businesses with a consistent sales volume and average transaction value, as it enables easy budgeting and reduces the likelihood of unexpected fees.

Conversely, percentage-based fees charge a variable rate based on each transaction’s amount. For example, a processor might take 3.5% on every sale. While this might seem beneficial for small transactions, as the cost fluctuates according to the sale, it can add up significantly when processing larger transactions. For businesses with high-ticket items, the unpredictable nature of these fees can hinder profit margins. As an example, a $1,000 transaction with a 3.5% fee would incur a $35 cost, which could affect pricing strategies and overall profitability.

Ultimately, selecting between flat-rate and percentage-based fee structures requires careful consideration of a business’s sales volume, transaction values, and strategic goals. Evaluating the implications of each pricing model allows e-commerce owners to choose the option that best aligns with their financial objectives, enhancing their operational efficiency and profitability in a competitive marketplace.

Negotiating Rates and Utilizing Low-Cost Payment Options

For e-commerce owners, payment processing fees can significantly impact overall profit margins. Therefore, negotiating rates with payment providers is crucial, especially for businesses experiencing high transaction volumes. One effective strategy is to initiate discussions with payment processors such as Stripe or Square, underscoring the volume of transactions your business processes. Providers are often open to negotiations, particularly if they see the potential for a long-term partnership. Prepare data that highlights your transaction history, growth projections, and competitive rates offered by other processors. This will position you as a well-informed client and may facilitate better terms.

Another tactic involves leveraging your existing relationships with financial institutions. Many banks offer tailored payment solutions with reduced fees, especially for businesses that maintain significant account balances. Understanding the nuances of different payment provider fees—such as interchange rates, transaction fees, and monthly costs—will enable you to identify areas for negotiation effectively.

In addition to negotiating better processing rates, exploring low-cost payment options can further alleviate financial burden. Automated Clearing House (ACH) transfers, for instance, are a cost-effective alternative to traditional credit card transactions. ACH transfers typically carry lower processing fees and can be especially beneficial for recurring payments or large transactions. By adopting such methods, businesses can retain more capital from each sale, leading to improved profitability.

It is also recommended that e-commerce owners regularly review and optimize their payment processing strategies. The payments landscape is dynamic, with new technologies and options continually emerging. Staying informed about industry trends and periodically reassessing your current processing solution will not only help in minimizing costs but also enhance the customer checkout experience, ultimately fostering customer loyalty and driving sales.